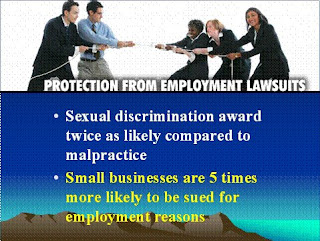

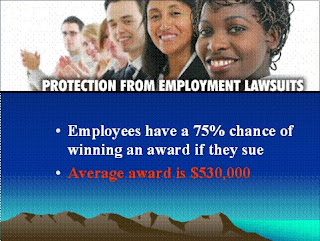

American business owners are 5 times more likely to be sued by an

employee than for any other reason, and employees win 75% of the time.

Remember that the people affected by these kinds of economic necessities take it personally, not just as a business decision, and will often turn a necessity based lay-off into a discrimination claim (or something worse) with the help of an employment attorney. Be sure you carefully document any staff reduction, whether based on economic necessity or performance; how would you react if you were fired or laid off amidst fears of a recession? Most people panic and grasp at straws.

Make sure you have adequate employee/work place policy manuals in place and that those manuals include detailed arbitration/mediation policies of the type we have discussed in the past. These policies give you opportunities to amicably resolve the issue in an informal way without being subject to the high risk, expense and distraction of a formal court proceeding. Caution – the “jury of your peers” will be made of employees – NOT employers, and given the current social, political and economic climate being a business owner is more dangerous than ever.

More importantly, if the agreement is properly drafted and implemented the employees (both new and old) MUST comply and we remove most of the economic incentive their attorney was motivated by. This is also a good time to review what your employees are doing with your clients and each other and to remind them of policies that you may have in place to protect you. We must be vigilant of the fact that you are responsible for their actions with clients and how they interact with each other as well. At times like this maintaining safe and proper procedures in everything from billing and id theft prevention to keeping the hallway floor dry is especially important.

If you are my client, or an advisor whose clients we serve, we have likely already discussed the PPDRP or “employee mediation agreement” which includes a mandatory mediation and arbitration policy for any employee-employer disputes, and which I strongly recommend for all clients who have employees. I really feel that this, in conjunction with a good employee handbook is an important step towards closing gaps that may be a source of liability.

The devil is often in the details, and issues with employees can be a huge exposure but can be easily and cost effectively addressed by implementing such a policy. We have thousands of these in place for clients across the U.S. including here in our office and in my family’s own businesses. Remember the employer is going to be held accountable, as the “deep pocket” for just about any grievance the employee has and that they employer is help responsible not just for what happens on the premises and their own interactions with the employee, but also how every employee interacts with the others, that’s a lot of variables! In your case multiply that variable by 50, or even 5 people you might have working for a particular business organization and the reason for my concern becomes clear. Employees are suing more often, winning an average of 75% of the time, and are winning proportionally larger and larger judgments. The average sexual harassment judgment as just one example has risen to $530K.

The problem with the stock arbitration clauses in most employee agreements is that they are unenforceable because they lack the specificity required by the courts. The same is true of the majority of dispute resolution policies we see. The policy we have discussed outlines a clear simple system of procedures that unambiguously provide steps for any employee with a grievance to follow. The agreement “provides actual notice” of the policy in a consistent manner and provides a road map for employees to follow that makes the employer aware of the issue and gives the employer 3 good faith chances to solve the problem before it escalates. As you probably know, many of these exposures occur when people feel they are at a dead end or have no voice or recourse.

The policy is recorded with the American Arbitration Association, is distributed to all employees and as we discussed is a modification of a workplace policy, not a contract that would require offer, acceptance and consideration to be valid and enforceable. The courts have consistently held, as in the landmark “Circuit City” case, that the employer does have the right to amend these policies but that they must “provide notice” of the changes to the employees. We do that and also include important items like a non-disclosure and confidentiality clause.

I hope this helps, please contact me with any other questions. This is a huge exposure that you can’t afford to ignore, especially given the fact that it takes a VERY small amount of time and money to insulate yourself from this exposure.