Year-End Tax-Scams Targeting Doctors and Business Owners

The year-end planning rush so familiar to physicians has many pitfalls including a variety of serious tax scams. Some scams covertly target you externally, while

The year-end planning rush so familiar to physicians has many pitfalls including a variety of serious tax scams. Some scams covertly target you externally, while

Issues in the news like the recent Ashley Madison data dump prove how negative publicity related to your practice or the personal activities of any of its owners

The last quarter of the year is historically an active time for physicians and business owners and their tax, legal and financial advisors. Given increased regulatory

Medical practices and other businesses of all types face many types of risk outside the strict scope of their professional liability. One major lawsuit risk to business owners and doctors

While this article was originally written for Physicians Practice, it applies to all employers and deals with a very significant asset protection risk, employee lawsuits.

We provide asset protection planning for many types of people. One of my favorite types of client is the successful business owner who is ready

I’m fortunate to deal with a number of successful women across the U.S. Whether they are C.E.O.s, doctors, some other kind of professional or business owner

Finding key documents can be trying and laborious under the best circumstances, even with plenty of notice, like at tax time every year. Finding them

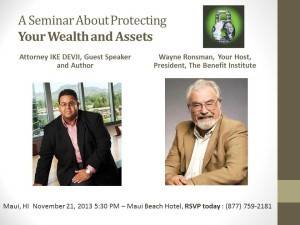

FOR IMMEDIATE RELEASE: Maui, HI. November 17, 2013. Asset Protection Attorney Ike Devji will be the featured guest speaker at a November 21st, 2013 educational

HIPAA and financial data present an ongoing asset-protection issue for physicians and medical practices. This week we take a look at a specific exposure suffered