This week we take a look at the tax liability associated with mortgage debt forgiveness and how it can be reduced or eliminated. Given what’s happened in the real estate market over the last six years of the recession this is a vital issue for both casual investors and real estate professionals like developers and builders. Arizona real estate attorney Chris Charles with the law firm of Davis Miles is our guest author. – Ike Devji

The general rule is that the forgiveness of debt is a taxable event. 26 U.S.C. § 61(a)(12). Debt forgiveness is included within the taxpayer’s gross income. For example, if I loan my uncle $100,000 to open a new fast food franchise and then later, I hit the Powerball and subsequently tell my brother not to worry about repaying the $100,000 loan, the I.R.S. will deem the $100,000 loan as taxable income for my brother.

The 2007 Mortgage Debt Relief Act

Important exceptions to the general rule, however, apply to mortgage debt forgiveness. Notably, pursuant to the 2007 Mortgage Debt Relief Act (the “Act”), the forgiveness of debt concerning a “qualified principal residence” is excluded from income tax. 26 U.S.C. §108. This essentially means that there is no tax liability on the short sale difference or foreclosure deficiency of a qualified principal residence. In order to qualify as a “qualified principal residence,” the loan must have been used to purchase or “substantially improve” the taxpayer’s principal residence. Principal residence is defined as the residence where the taxpayer has resided for a “period aggregating two of the last five years.”

The Act has three major limitations: (1) it sunsets at the end of 2013; (2) it does not apply to commercial properties; and (3) it only applies to the taxpayer’s primary residence.

Fortunately, many property owners in Arizona can benefit from other exclusions under the tax code without the need to rely on the Act.

The Insolvency Exception

For example, if the taxpayer is insolvent at the time of the mortgage debt forgiveness, the taxpayer can exclude liability for the debt forgiveness, even if the property is an investment property or vacation home. 26 U.S.C. §108(a)(1)(B).

The IRS’s definition of insolvency essentially means that the total sum of the taxpayer’s liabilities exceeds the total sum of the fair market value of the taxpayer’s assets, on the date immediately preceding the debt forgiveness.

The Bankruptcy Exception

Also, if the debt is discharged in bankruptcy, then there is no liability for the debt forgiveness, as long as the taxpayer filed the petition for bankruptcy before the debt forgiveness, e.g. before the completion of the short sale or foreclosure.

Capital Loss May Offset Any Debt Forgiveness Income Tax

Further, even if the Act does not apply, and if neither of the above exclusions apply, the taxpayer may be able to claim a capital loss regarding the disposition of the property, which may offset any debt forgiveness in regard to an investment property.

Non-Recourse Debt Exception

Finally – and perhaps most importantly in Arizona – there is no tax liability for mortgage debt forgiveness regarding “non-recourse debt.” Treas. Reg. § 1.1001-2(a)(2) and (c), Ex. 8; see also Rev. Rul. 90-16, 1990-1 C.B. 12. Non-recourse debt means that the creditor can seize only the property that secures the loan, even if the fair market value of the property is not sufficient to cover the loan balance. Non-recourse debt can be the result of express contract or the result of statute, as in the case of Arizona’s anti-deficiency statutes.

Thus, even if the Act expires and none of the above exemptions apply, the taxpayer may still have arguments to exclude tax liability for mortgage debt forgiveness if the loan is non-recourse under Arizona law. The Arizona appellate courts have broadly interpreted Arizona’s anti-deficiency statutes and recently extended their protection to vacant land in some cases. See M & I Marshall and Ilsley Bank v. Mueller, 228 Ariz. 478, 268 P.3d 1135 (App. 2011).

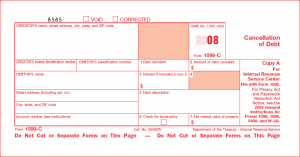

Even if the loan is non-recourse, the lender will still issue the IRS Form 1099-A or 1099-C by February 2nd of the year following the mortgage forgiveness.

Importantly, the issuance of the 1099 is not dispositive on the issue of whether any tax is owed. Instead, the taxpayer can respond to the 1099 with the Form 982 and identify which of the above exceptions apply and identify why no tax is owed.

In sum, although the forgiveness of debt may create tax liability, taxpayers have several options for avoiding liability. Please visit Mr. Charles’ attorney page at www.davismiles.com to download a free manual regarding mortgage debt forgiveness.

Christopher Charles is an experienced real estate lawyer and a former “Broker Hotline Attorney” for the Arizona Association of REALTORS® (AAR). He is a Partner with the law firm Davis Miles McGuire Gardner, PLLC where he serves as the chair of the Real Estate Practice Group. Mr. Charles is an Arbitrator and Mediator for AAR regarding real estate disputes; he serves on the State Bar of Arizona Civil Jury Instructions Committee where he helped draft the Agency Instructions and the Residential Landlord/Tenant Eviction Jury Instructions.

Mr. Charles is a licensed real estate instructor and teaches continuing education classes at the Arizona School of Real Estate and Business. For a list of upcoming speaking engagements, please visit www.davismiles.com. he can be reached at ccharles@davismiles.com